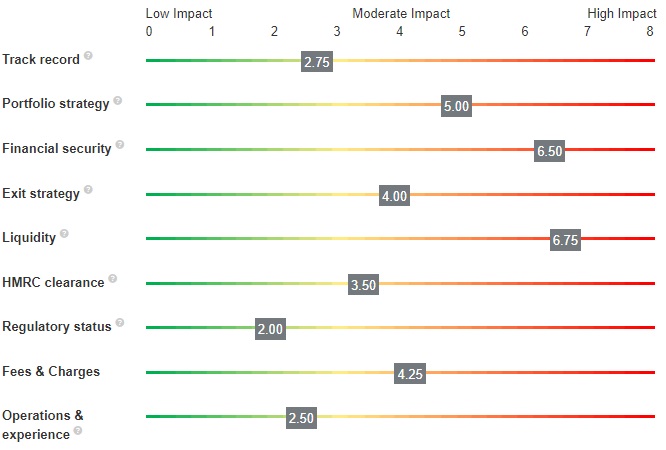

Our MICAP Impact Scores have been designed in concert with our MICAP Reviews. They focus on nine key aspects to assess their likelihood of having an impact on the investment.

Our proprietary scoring system is based on a completely objective assessment of public data and the Managers’ responses to our due diligence questionnaire every quarter. All data are converted into numbers, which are then combined to produce scores across nine aspects. The nine aspects we assess are Track Record, Portfolio Strategy, Financial Security, Exit Strategy, Liquidity, HMRC Clearance, Regulatory Status, Fees & Charges, and Manager Operations & Experience, each scored from zero to eight.

A lower score is good: it represents that the specific aspect is unlikely to have a significant impact on the investment, whereas a high score represents an aspect that is likely to have a higher impact on the investment.

For instance, in the example below the investment has a high score for both liquidity and exit strategy. In determining the investment’s suitability this particular one may not be appropriate if access to funds may be required in the foreseeable future.

The focus of each of the nine aspects is outlined below:

Track Record

This considers how well the investment has performed over time. For EIS this considers factors such as the number of companies invested in, the number of above-par exits achieved and the realised and unrealised ROI since inception. For VCTs this considers factors like the one- three- and five-year NAV total return and dividend history. For unlisted BR this looks at factors such as the length of time the service has been operating, the annualised returns achieved since inception compared to its target return and the relevant sector experience of the manager, and for AIM BR this considers factors such as the published performance of the model portfolio over up to 10 years relative to its peers.

Portfolio Strategy

This examines the diversification of the offer, as a measure of the investors’ exposure to any one company, asset or sector. For unlisted BR this considers factors such as the AUM of the service, whether or not investors co-invest into one pooled investment vehicle or whether investors are only allocated into certain deals, the sectors that the fund is invested across and the percentage of the AUM that the top 10 assets and top one asset represents. For AIM BR, VCTs and EIS this considers factors like the number of companies investors will be exposed to (and the net asset value for VCTs) and the sector allocations. Lower diversification can often mean higher risk, and so a higher score here can denote an investment with a narrower focus.

Financial Security

Investments can fail for many reasons, and this seeks to illustrate the level of downside mitigation in place, should things go wrong. For EIS and VCTs this considers factors such as the stage of company that the manager targets (as earlier stage companies will typically be less commercially advanced than later stage companies), the average deal size and whether the manager has board representation to safeguard investors’ interests. For AIM BR this considers factors like the largest investment in an investor’s portfolio and the market cap of the companies that the manager targets. For unlisted BR this considers numerous factors specific to the sectors that the service targets, plus other factors such as the gross returns the service targets, the amount of borrowing in the service and whether there are independent directors on the boards of the investee companies to provide oversight to the investment and valuation process.

Exit Strategy

The exit strategy for an investment determines when that exit should take place, how long the process is expected to take and any factors that it is reliant on. SEIS funds will have a higher Exit Strategy score than EIS funds, because the investee companies will be younger (and so typically further from an exit event). A higher score can also denote that the manager has less of a track record of facilitating exits for investors within that particular EIS or SEIS fund, outside of that fund or even more broadly outside of the tax-advantaged market (although this does not consider the personal track records of any of the Manager’s principals or investment team). Please note that AIM BR, unlisted BR and VCTs are not scored for Exit Strategy because it is expected that investors will remain invested until they (or the administrators of their estate/beneficiaries) request a withdrawal, and so the Liquidity score should be considered instead.

Liquidity

This considers how readily an investor can access their funds outside of any exit strategy organised by the Manager. Ignoring any potential loss of tax relief, this considers how quickly an investor can liquidate their holding. For EIS funds, liquidity is expected to be very limited and so these will all score highly for this impact. For AIM BR this considers factors such as the target liquidity of the service and the market cap of the companies the manager targets. For unlisted BR this aspect considers items such as the percentage of AUM held by the largest investor, the inflows and net inflows, the target liquidity, the average withdrawal time over the last 12 months and the nature of the assets invested in (i.e. how liquid the assets are). For VCTs this considers factors such as the discount to NAV that the VCT’s shares trade at and any share buyback offered by the VCT.

HMRC Clearance

Tax reliefs are not guaranteed, and this section examines the relative risk of tax relief being granted. BR investments will have the highest score here as the tax relief cannot be pre-cleared by HMRC and is assessed at the date of death. For unlisted and AIM BR this considers factors such as whether or not a third-party tax adviser assesses the service and the assets each year, whether or not an opinion by a lawyer/tax adviser has been obtained on the likelihood of the service qualifying for Business Relief, any in-house tax qualified staff the manager has, and the number of successful claims the manager is aware of. For EIS this considers factors such as whether or not EIS advance assurance is obtained specific to the fundraise and noting the manager, who the advance assurance applications are completed by, any in-house tax expertise the manager has and the average and longest time taken for investors to receive their tax certificates in the last 24 months. For VCTs this considers factors such as whether the VCT has full approval, whether the manager gets a tax qualified opinion on all new deals prior to deployment of funds, any in-house tax expertise the manager has and whether (and how often) the manager retains a tax qualified firm to review the VCT’s holdings and the VCT’s compliance with HMRC requirements.

Regulatory Status

Investments are subject to a number of different rules regarding how and to whom they can be marketed. A higher score signifies that this investment’s marketing material has not been approved by an FCA regulated firm, or that there are no FCA regulated firms involved with the management of this investment.

Fees & Charges

To help advisers demonstrate that they have considered the price and value outcome of the Consumer Duty, this score considers the fees and charges of the investment based primarily on modelling the fees of each investment over a given investment period. A higher score indicates that the total fees received by the manager (and any third-party service providers) are relatively high compared to its peer group.

Operations & Experience

This considers the financial strength and relevant experience of the FCA Authorised Manager (and where relevant the Investment Adviser) based on numerous factors such as the number of years the firm has been trading, its net assets, average profits over the last three years, Experian credit rating, the number of full-time staff, number of board-level directors and number of investment professionals working for the firm, whether or not the company’s accounts are audited, the debt/equity ratio and current ratio of the company, plus its tax-advantaged and other AUM.

Please note: the MICAP Impact Assessment process is based on public data and the Managers’ quarterly answers to our Impact Assessment Questionnaire. While MICAP has systems in place to audit the information received each quarter, certain information used to generate the MICAP Impact Scores may not be verified or audited by MICAP. MICAP Impact Scores should not be taken as financial advice or a complete and comprehensive analysis of the risks of investing in the investment, which are usually set out in the Information Memorandum, Prospectus or Brochure supplied by the Investment Manager.